Stablecoins offer a combination of the traits of cryptocurrencies and a fixed real-world asset, often fiat.

The most popular use for stablecoins is to provide users the advantages of cryptocurrency and the blockchain, such as decentralization and quick, low-cost transactions, but with the stability of its fiat peg.

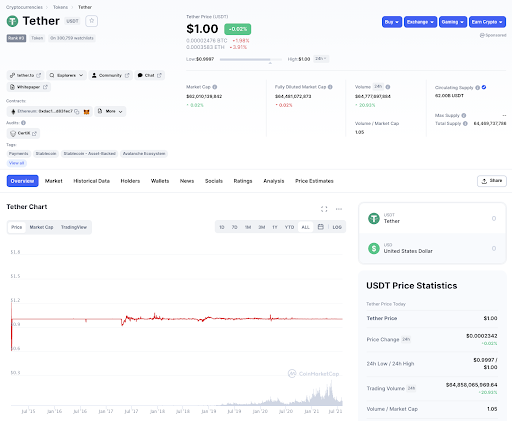

For example, popular stablecoins USDC, USDT, and GUSD will, in theory, always equal $1.00. However, in execution, stablecoin value may differ by 1 to 5% in either direction.

To give an idea of the current state of stablecoins, consider that as of Aug. 2, 2021, the market cap of Tether (USDT) is $61.9 billion. It is the third-largest cryptocurrency by market cap, only following Bitcoin and Ethereum. USD Coin (USDC), owned by Coinbase, has the seventh-largest market cap at $27.4 billion.

Stablecoins Get Inspiration From Fiat

The strategies used to maintain stablecoin value are similar to how governments and central banks control the prices of fiat.

The primary method is the use of reserves to back the fiat. The controlling authority, similar to a central bank, takes actions to control the supply and demand. An example of the latter is when the central bank prints more money in what is called quantitative easing.

However, instead of being used to manipulate economies, stablecoins serve the goal of providing cryptocurrency holders the ability to escape volatility while remaining in the cryptocurrency ecosystem.

Different Types of Stablecoins

Stablecoin creators decide which method to use before creating the coin, with each method leading to a different type of stablecoin.

Let’s explore the various types you may come across.

Fiat-backed Stablecoins

People are most familiar with fiat-collateralized stablecoins.

For example, assume a stablecoin is tied to the US dollar. A custodian would hold $1 for every stablecoin issued. This provides stability by ensuring that stablecoin holders could theoretically exchange their stablecoins for $1 at any time. This $1 would come from the reserves used to collateralize the issuance of the stablecoin asset.

This is the most common method of ensuring the value of stablecoins. Popular stablecoins Tether (USDT) and True USD use this method with the US dollar as collateral.

Commodity-backed Stablecoins

Some stablecoins use other assets as collateral, such as precious metals like gold or silver or even oil. Digix, for example, uses gold as collateral.

Cryptocurrency-backed Stablecoins

Some stablecoins use cryptocurrency as collateral.

These stablecoins attempt to account for the inherent volatility of cryptocurrency by reserving more cryptocurrency than you would need for a 1:1 ratio, known as over-collateralization.

For example, this method could involve storing $2 worth of the crypto as collateral for each $1 of the stablecoin. These crypto-backed stablecoins also typically include more frequent monitoring and audits to boost price stability further.

A popular example of this method is DAI from MakerDAO, which is backed by Ethereum.

Non-collateralized Stablecoins (Uncollateralized or Algorithmic Stablecoins)

Finally, some stablecoins don’t rely on reserves and are therefore non-collateralized stablecoins.

Referred to as algorithmic stablecoins, these digital assets rely on smart contracts to monitor prices and determine supply and demand.

In practice, the smart contracts are set to buy stablecoins from the circulating supply if prices are too low. When the prices are too high, the smart contracts issue new stablecoins.

Basecoin is one popular example of this type of stablecoin.

Somewhat ironically, non-collateralized stablecoins are similar to how the government controls the prices of fiat. For example, a central bank may print more bills if prices are too high, and it may issue bonds to “buy back” currency off the market.

Collateralized vs. Uncollateralized Stablecoins

The most significant difference in a stablecoin type is if it’s collateralized or not.

Collateralized stablecoins maintain their value via large reserves of collateral, whether that is fiat, crypto, precious metals, or another commodity. On the other hand, uncollateralized stablecoins maintain their value via smart contracts that manipulate supply based on demand.

You can think of each as using a different one of the methods commonly used by central banks to control inflation. Collateralized stablecoins are the crypto-equivalent to keeping reserves, while uncollateralized stablecoins are the equivalent of printing money or taking another action to control supply.

Uncollateralized stablecoins have the benefit of being more decentralized due to the use of smart contracts. They also don’t require large stores of collateral, meaning they require a significantly lower upfront investment to start.

By contrast, collateralized stablecoins provide more confidence in the coin due to the presence of reserves.

Reserves add a crucial layer of familiarity, transparency, and trust. Reserves also overcome concerns that the uncollateralized stablecoin oracles providing the smart contract with data could use unreliable or biased sources.

Crypto-backed stablecoins and uncollateralized stablecoins tend to be more decentralized, assuming the oracles used for uncollateralized stablecoins are honest.

Fiat-backed cryptocurrencies are more centralized, as there needs to be a central (or multiple) location where the reserves are physically (or digitally) stored.

Pros and Cons of Stablecoins

Stablecoins provide the benefits associated with cryptocurrencies, including quick transaction times, low transaction fees, cross-border functionality, decentralization, an immutable ledger for transparency, and access to all.

Since they usually always equal $1, traders often use them to escape volatile downswings in the market. Many people also see stablecoins as a safe option for storing their assets, which is particularly true in countries experiencing hyperinflation or political instability. Essentially, a stablecoin enables anyone with access to the Internet to buy into USD without going to a brick-and-mortar exchange.

They can also be used to transact with parties around the world using a fixed-peg standard. As you can imagine, it’s difficult to pay in BTC or ETH if the price is changing every second.

However, a hidden advantage of stablecoins that only came into fruition recently was their adaptation for cryptocurrency interest accounts and DeFi. A cryptocurrency interest account platform, such as BlockFi or Celsius, offers users a percentage APY (around 7% to 10%) on their stablecoin deposits. These companies then lend out those deposits in collateralized loans to other users, generating some profit for themselves. DeFi accomplishes the same thing, but without a centralized company acting as an intermediary.

While stablecoins have become incredibly popular and are essentially a household infrastructure of the crypto ecosystem, some have concerns about their collateral reserves.

Regulation and Financial Concerns with Tether

One of the big criticisms of stablecoins comes from a regulatory standpoint. As the largest stablecoin by market cap, Tether has faced the most criticism due to its potential impact.

For example, Tether (USDT) has been the target of multiple official and unofficial audits to urge the company to provide it actually has U.S. dollars to back up its stablecoin holdings.

If a “collateralized” stablecoin doesn’t have the actual reserves to back up its digital issuance, the 1:1 peg would be thrown out of whack, and few people would lean into using a stablecoin that isn’t really worth what it says it is.

An unofficial audit of Tether in June 2018 brought some pause to the Tether scandal; the audit confirmed USDT did have the necessary reserves.

Scandal returned into the palette of stablecoin holders in March 2019, when Tether diluted its claims that the U.S. Dollar fully backed USDT.

Concerns resurfaced in a May 2021 report from Tether, which revealed that only 2.9% of Tether’s reserves were in cash. The rest was in short-term unsecured debt called commercial paper. This makes it among the ten largest commercial paper holders in the world. But importantly, Tether is not regulated, while those other holders are.

If investors lost confidence in Tether since it has such a large role in the industry, it could lead to unpredictable and severe negative effects on the rest of the cryptocurrency market.

Since Tether isn’t regulated, economists warn that the asset could cause larger problems for the cryptocurrency world if it continues to grow in usage.

The Question of Decentralization

Decentralization is one of the primary features of cryptocurrency, and this stablecoin discussion brings us to question how decentralized cryptocurrency can possibly be.

Pegging a cryptocurrency to fiat means it is subject to the same external and centralized influences as the fiat backing.

Like the EOSDT stablecoin by Equilibrium, some claim this can be overcome with over-collateralization with other digital assets.

Critics also point out that some stablecoins are not decentralized, so users should be aware of how much they value this feature.

For example, JPM Coin, a stablecoin from JPMorgan Chase, is owned by a centralized company. This stablecoin is designed to improve the speed of international transactions. Critics argue that the crypto community should not trust a bank from Wall Street, especially as Anthony Pompliano says, one “that was previously charged with a felony.”

Another example of companies embracing stablecoins comes from IBM and Stellar, who created the World Wire. This blockchain-powered system lets international banks create stablecoins using their local fiat as collateral. There is reportedly already interest from the Philippines, South Korea and Brazil.

Facebook is also working towards creating its own fiat-pegged stablecoin. The move has spawned mixed reactions, including from critics who are unsure that they could trust a coin from a company with many privacy concerns.

Cryptocurrency hard-liners argue that stablecoins could negatively impact the industry and that stablecoins are stepping on the toes of cryptocurrencies that have been working hard to create a decentralized economy that aims to escape the fiat world rather than embrace it.

The Future of Stablecoins

Some cryptocurrency enthusiasts and advocates of stablecoins suggest implementing an open standard, hoping the standardization will increase accountability in the stablecoin space.

Another attribute frequently advocated for is self-governance, which users in search of decentralization would appreciate.

Final Thoughts

Stablecoins address the volatility associated with cryptocurrency by pegging themselves to a more stable asset, like a fiat currency. They are growing in popularity, and with more stablecoins entering the market, the future will determine just how useful they really are.

For one, people can immediately benefit from stablecoins by sending dollar-pegged payments to each other anywhere around the world in a decentralized fashion.

However, perhaps the most exciting aspect of stablecoins is that they could potentially encourage the tokenization of the global economy. If fiat can be used as an asset peg, why not anything else? Why not real estate, ownership in a company, or a work of art?

Sources:

https://www.investopedia.com/terms/s/stablecoin.asp

https://cointelegraph.com/explained/stablecoins-explained

https://www.nerdwallet.com/article/investing/stablecoin

https://medium.com/@izakfr/uncollateralized-stablecoins-basis-d7a6016a14f

https://medium.com/stabletrade/the-risk-of-uncollateralized-stablecoins-d507c10adb8e

https://www.blockchainbeach.com/what-are-stablecoins-and-why-do-they-matter/

https://www.cnbc.com/2021/07/07/tether-cryptocurrency-usdt-what-you-need-to-know.html

https://www.coindesk.com/why-stablecoins-are-suddenly-in-the-news